Third-party audits of tax relief companies

We verify IRS filings, payments, and case activity—so clients can see what’s actually been done on their case.

Trusted by 1000+ users

We verify IRS filings, payments, and case activity—so clients can see what’s actually been done on their case.

Trusted by 1000+ users

Some things take time. Sometimes, there's an issue.

Tax relief firms promise results—but how do you know what has been done? We offer you an independent, transparent report on your IRS case.

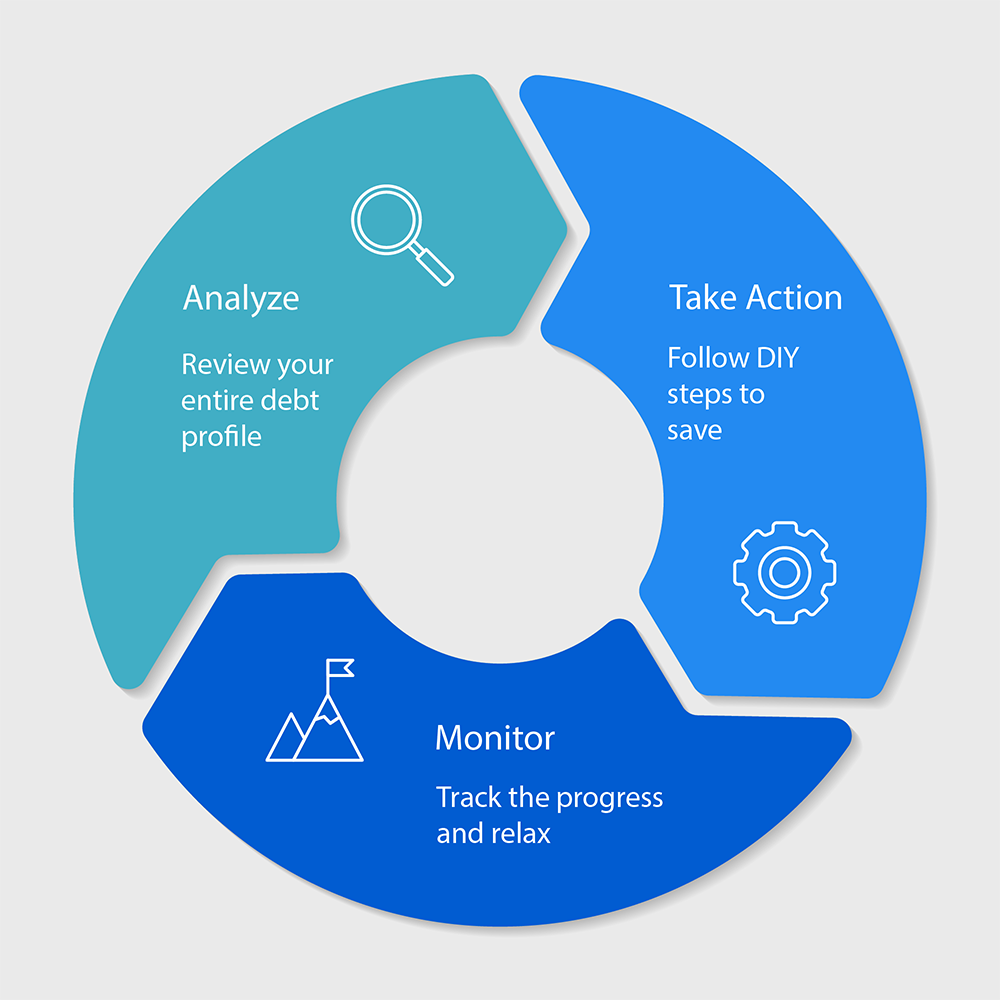

Get an unbiased analysis of your IRS tax issue to see what has been, what has not, and what steps you can take.

We offer flat fees, no hidden charges. Get affordable access to your tax case audit and see what you've been missing.

Your data is encrypted, confidential, and you may cancel at any time.

We help people see the truth behind the talk

"We are here to help the millions of taxpayers who simply want to see proof.

Verified, Inc. independently audits IRS cases to confirm tax relief activity and progress to bring transparency and accountability to the industry."

We helped Leslie understand her case and proved all tax returns were filed. However, she was in active-collections and there was no solution submitted.

Our audit indicated that Alice paid a firm twice what she owed the IRS. She had the proof she needed to file a claim and get her money back.

Our team determined there was an active power of attorney on file, transcripts were requested, but no tax returns were filed, and no settlement requested.

We were able to deliver verification that Robert's case was completed and that service fees were earned.

See the facts, get the fix.

Get a report with your tax balance, missing tax returns, penalties, interest, liens, and more.

See your IRS Status and your tax relief progress.

Your results and satisfaction are backed by our risk-free guarantee.

Your report will show if anyone has called the IRS, is on power of attorney, stopped collections, filed returns, or reduced your tax. If you have not hired someone, we can still help. Discover how to fix your tax case— step by step.

Once a year the IRS shares statistics on the financial health of the United States in terms of tax. We've seen the largest jump in taxes since 2019. The largest increases are amount of non-filers and IRS field agent collections.

Unbiased, independent proof

Trusted by 1000+ users

Save thousands in legal fees. No long-term contracts. Cancel any time.

$65 /per month, billed annually

A 10-year comprehensive tax report showing:

PastDu/Verified

$125 /per month, billed annually

10-year business and personal tax report:

PastDu/Verified